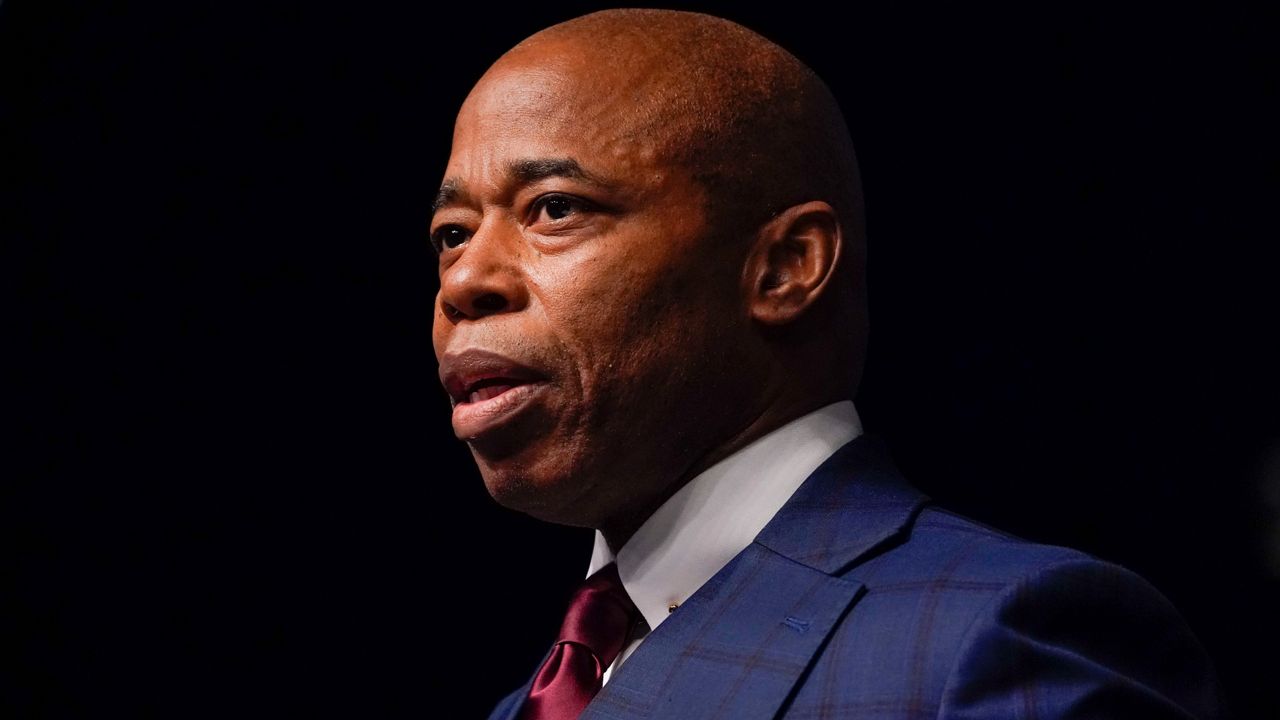

Mayor Eric Adams’ cryptocurrency portfolio – alongside those of nearly every other investor in digital coins – has taken a substantial hit this year.

Ahead of taking office, Adams pledged to take his first three paychecks in cryptocurrency, using an app to automatically invest his net take-home pay in bitcoin and ethereum, two of the most popular digital currencies.

Adams’ crypto portfolio has likely lost about 30% of its value, given the losses to bitcoin and ethereum, though Adams has not disclosed how much of each cryptocurrency he purchased, and whether he has bought more or sold them off.

The wild volatility of the cryptocurrency market has complicated Adams’ efforts to talk up the possibilities for city government in blockchain technology, which underpins cryptocurrencies and which experts say could be used to revolutionize government and policy-making.

Earlier this week, Adams said that using blockchain technology to create fraud-proof record-keeping systems for birth certificates, property deeds and other government documents was the “way of the future.”

Experts say he is muddling his message on cryptocurrency by lending the authority of his office to a controversial financial product rather than taking steps to make use of blockchain technology in city government.

“Mayor Adams is well within his rights to invest his personal money in crypto,” said Jason Furman, a professor of economic policy at the Harvard Kennedy School. “But it is a big mistake if he is betting any part of the future of New York City on a technology that has largely been a solution in search of a problem and whose recent collapse should give serious pause to its boosters.”

In an emailed statement, a City Hall spokesperson said that Adams “believes cryptocurrency and blockchain technologies can play a key role in promoting an equitable recovery and building wealth in underserved communities throughout our city.”

“New York City is the center of the finance industry, and this city can be at the forefront of these emerging new sectors,” the spokesperson said.

Adams defended his cryptocurrency purchases Wednesday when speaking to reporters at City Hall, saying he bought the digital tokens as a symbolic effort to showcase that New York City should be a center of technological innovation. He said he had stopped buying the coins after the third check.

“Three checks, that’s a wrap,” Adams said. “We are going to be the center of technology. That's who we are.”

As Adams invested a total of about $19,200 in cryptocurrencies, their values were fluctuating wildly: On the day he received his first check, Jan. 21, bitcoin’s value had fallen $4,000 from the previous day’s closing figure. By the time of his next check, the currency had completely recovered that loss.

Since then, however, cryptocurrencies have continued a downward slide from a Nov. 2021 high. One bitcoin is currently worth about $32,200, down from about $47,700 at the beginning of the year.

Adams is the only mayor in recent memory to give a tacit endorsement to a financial product, according to Susan Lerner, the executive director of Common Cause NY, a government reform group.

“Whether it's cryptocurrency or policing devices or some form of kitchen tool, it's not the mayor's job to be pitching private products,” Lerner said.

Lerner said that even though cryptocurrencies are seen by boosters as representing the technological vanguard, they are too risky to present to city residents as symbolic of innovation in general.

“He isn’t qualified to be pushing financial products on New Yorkers,” Lerner said.

One way for Adams to recoup his rhetorical losses on cryptocurrency — if not his financial losses — would be to actually use blockchain technology in a meaningful way in the city, said Robert Hockett, a professor of financial regulation at Cornell Law School.

Blockchain is the technology that underpins cryptocurrencies. It functions as a ledger system that is created and maintained not by a central authority but by a network of computers, and which makes it impossible to introduce changes to existing records without leaving clear, publicly visible proof.

Hockett said that Adams could institute an idea that Hockett is advocating for at both the state and federal level: Creating a public, blockchain-based network of digital wallets through which city residents and businesses could collect government funds, pay bills and transfer money to one another in U.S. dollars. Some experts have described the idea as a publicly run cash-transfer app, such as Venmo or Cashapp.

Such a network, Hockett said, would create digital money holdings for the nearly 10% of city households that do not have bank accounts, allowing government benefits to flow much more quickly to residents that need them most.

“If he had me as an adviser, I’d say, ‘Here's a way to get the egg off your face from what bitcoin is doing right now,’” Hockett said. “He could say, I've helped disadvantaged New Yorkers and I've lived up to my desired reputation as a tech visionary.”

State Sen. Julia Salazar and Assemblyman Ron Kim are sponsoring legislation at the state level to create a similar system.

A spokesperson for Adams declined to comment on whether Adams has followed through on a pledge made last November to form a committee to determine potential uses for blockchain in the city.

At a tech conference this week, Matt Fraser, the city’s chief technology officer, said that the city was “exploring” new technology for documents like birth certificates, identity cards and property management records.

“When you look at technologies like blockchain and what we can do, by real-time records validation and asset transfer, that’s the kind of stuff we’re looking at layering into government,” Fraser said.